Personal finance software helps me handle my money with apps or computer programs. I use it to watch my spending, make savings goals, and pay bills when they are due. A Bankrate survey says 63% of smartphone users in the United States have at least one financial app.

Most people, like me, want to stop missing payments, sort their expenses, and reach goals like saving for a house or paying off debt. These tools help me see where my money goes and help me make better choices.

Key Takeaways

- Personal finance software lets you see your spending. It helps you make budgets and save money in one spot.

- These tools link to your bank accounts and credit cards. They update your money details by themselves and keep it safe.

- You can use budgeting, expense tracking, alerts, and reports. These help you handle your money and not miss payments.

- There are desktop, mobile, and web-based choices. You can choose the one that matches your needs and life.

- Picking the right software means looking at features, safety, price, and reviews. This helps you find what is best for you.

“Budgeting has only one rule: Do not go over budget.” – Leslie Tayne

What It Does

Core Functions

When I use personal finance software, I see it has many helpful features. These features make it easier for me to handle my money. Here are some things the software does for me:

- It keeps track of what I spend and helps me follow my budget.

- It helps me watch my investments and reach my savings goals.

- It makes reports that show how I use my money.

- It links to my bank accounts and credit cards for quick updates.

- It protects my financial information with strong security.

- It lets me plan for big things, like retirement or buying a house.

- It helps me keep important papers and manage business money if I need to.

I like that I can put all my accounts together in one place. This means I can see my checking, savings, credit cards, and investments at the same time. Some apps even let me handle things like 529 plans or health savings accounts. I do not have to log into many websites to see everything.

Tip: I always make sure the software works with my bank and uses good encryption before I connect my accounts.

Money Management

Personal finance software makes it much easier to manage my money. I can see all my accounts in one spot, so I know how much money I have. The software tracks my spending and puts it into groups like groceries, rent, or fun. This helps me see where I spend the most.

Here is a table that shows some features I use every day:

| Feature | What It Does |

|---|---|

| Account Aggregation | Shows all my bank and credit accounts together. |

| Transaction Tracking | Automatically sorts my spending into categories. |

| Budgeting | Lets me set spending limits and track progress. |

| Cash Flow Forecasting | Predicts my future balances based on my habits. |

| Subscription Management | Finds and tracks my recurring payments. |

| Reporting | Gives me charts and graphs to see trends in my spending and saving. |

The software sends me alerts when I am close to my budget or when a bill is due. This helps me not pay late fees or spend too much. The software does a lot of work for me, so I do not have to type in every purchase. Sometimes, I need to check for mistakes or fix a group, but it still makes things easier.

I also use the software to set savings goals. If I want to save for a trip, I can set a goal and the app tells me how much to save each month. The software helps me find things I do not need, like unused subscriptions, so I can save more money.

Note: These tools help a lot, but they work best if I use them often and keep my accounts connected. Sometimes, there are problems syncing or I have to fix things by hand, but I think the good parts are worth it.

“Do not save what is left after spending, but spend what is left after saving.” – Warren Buffett

Personal Finance Software Features

Budgeting Tools

I use budgeting tools in personal finance software to plan my spending. These tools help me set limits for things like groceries, rent, and fun. I can check how much money I have left each month. Some apps, like YNAB, use zero-based budgeting. This means I give every dollar a job.

Other apps, like Personal Capital, help with long-term planning and investments. Monarch Money gives tips to help me spend less. Cleo uses AI to make budgeting simple and fun. Here is a table that shows how some popular budgeting tools compare:

| Tool Name | User Satisfaction | Budgeting Methodology | AI Features & Impact |

|---|---|---|---|

| Personal Capital | 4.8/5 (App Store) | Investment & long-term focus | 40% higher savings with AI |

| YNAB | Strong user loyalty | Zero-based budgeting | Predictive budgeting suggestions |

| Monarch Money | 25% expense reduction | Hybrid, personalized advice | AI identifies overspending |

| Cleo | Easy to use, accessible | Personalized recommendations | Conversational AI advice |

Tip: AI features in these tools help me spend less and reach my goals faster.

Expense Tracking

Personal finance software makes tracking expenses easy. I link my bank accounts, and the software brings in my transactions. It sorts my spending into groups, so I know where my money goes. NerdWallet and Spendee let me sync accounts and see expenses right away. If my bank does not connect, I can import files. Here are some ways these methods work:

| Method | Description |

|---|---|

| Bank Account Syncing | Brings in transactions from linked accounts automatically |

| Importing Transaction Files | Updates expenses using files like CSV or QIF |

| Automatic Categorization | Sorts expenses into groups for easy tracking |

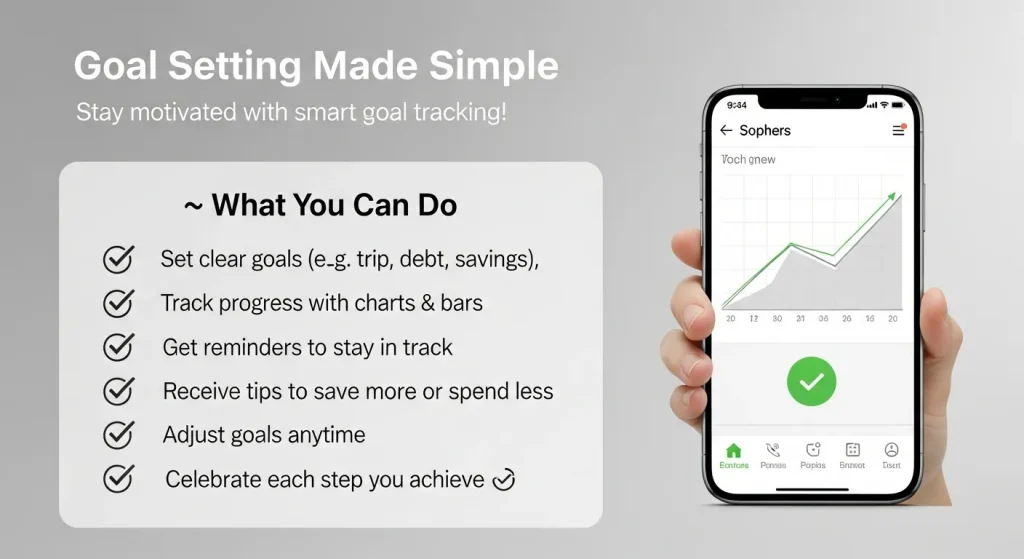

Goal Setting

Setting goals helps me stay motivated. I use personal finance software to decide what I want, like saving for a trip or paying off debt. The software lets me set steps and deadlines. I see my progress with charts and bars. I get tips to save more or spend less. I can change my goals if I need to. The software celebrates when I reach a step, which makes saving feel good.

- I set clear goals and watch my progress.

- I get reminders to help me stay focused.

- I get advice to spend less or save more.

- I can change my goals if my plans change.

Alerts and Reminders

I do not miss bills because my software sends alerts. I get reminders before payments are due. If my balance is low, I get a warning. Some apps stop me from spending too much, so I do not get overdraft fees. I can change these alerts to fit what I need. This helps me stay in control and avoid surprises.

Note: Automatic bill payments and alerts help me avoid late fees and feel calm.

Reporting

Reports help me learn about my money. I can see income statements, balance sheets, and cash flow reports. The software lets me make custom reports to track spending or income. I use dashboards with charts and graphs to see trends. This helps me make better choices and plan ahead.

- I make standard reports like profit and loss statements.

- I create reports that fit what I need.

- I use dashboards for quick updates and easy charts.

“It’s not how much money you make, but how much you keep.” – Robert Kiyosaki

Types of Personal Finance Software

There are three main types of personal finance software. These are desktop, mobile, and web-based. Each type is good for different people and needs.

Desktop

Desktop software gives me strong features and control. I install programs like Quicken or HomeBank on my computer. I can use them without the internet. My data stays on my computer, so it feels safer. Desktop software helps with investments and business money. I have to update the software myself, which takes time.

Tip: Desktop software is best if I want privacy and advanced features.

Mobile

Mobile apps help me manage money anywhere. I use apps like Mint, YNAB, Goodbudget, or Rocket Money on my phone. These apps send alerts and track my spending. I can set goals wherever I am. Mobile apps are easy to use and update quickly. Many connect to my bank and show my balance right away. Some, like Greenlight, help families teach kids about money. Mobile apps often work with web versions, so I can use both.

Web-Based

Web-based software lets me see my money from any device. I use tools like Mint, Monarch, Simplifi, or PocketSmith in my browser. These tools update by themselves and do not need to be installed. I can log in from my laptop, tablet, or phone. Web-based software connects to many banks and uses strong security. Many people pick web-based software because it is easy and always current.

Here is a table that shows the main differences:

| Aspect | Desktop (e.g., Quicken) | Mobile (e.g., Mint, YNAB) | Web-Based (e.g., Monarch, Mint) |

|---|---|---|---|

| Access | One computer, offline | Smartphone, on the go | Any device with internet |

| Data Storage | Local on device | Cloud or device | Cloud |

| Updates | Manual | Automatic | Automatic |

| Features | Advanced, robust | Convenient, alerts | Easy access, broad integration |

| Popular Platforms | Quicken, HomeBank | Mint, YNAB, Rocket Money | Mint, Monarch, Simplifi |

Web-based software is the most popular because it works everywhere. It connects to many banks. Mobile apps are next because they are easy and give fast alerts. Desktop software is still liked by people who want privacy and more features.

Benefits

Financial Awareness

When I started using personal finance software, I understood my money better. The software shows me updates on my spending, saving, and investing right away. I can see where my money goes every day. This helps me notice habits I should change.

Many apps have fun things like quizzes or progress bars. These make learning about money more interesting. I feel more sure of myself because I can track my goals and see how I am doing. Some platforms use mobile-first designs, so I can learn and manage money anywhere. I see that these tools make hard topics simple. As I use the software, I learn how to make smart choices with my money.

Automation

I save a lot of time with automation. The software sorts my expenses, pays my bills, and manages my savings for me. Here are some ways automation helps me:

- AI-powered apps put my spending into groups, so I do not have to.

- Automatic bill payments help me pay on time.

- Tools like Rocket Money and Plum keep all my tasks in one place, so it is easy to manage.

| Automation Task | How It Helps Me | Time Saved |

|---|---|---|

| Expense Categorization | Sorts spending automatically | High |

| Bill Payments | Pays bills on time | High |

| Subscription Tracking | Finds and manages recurring payments | Medium |

I feel less worried because I do not have to remember everything. Automation lets me focus on bigger goals.

Decision Support

Personal finance software helps me make better choices. I always have the latest information because the software connects to my bank. I use budgeting tools to set goals and watch my spending. The software shows me patterns in my expenses, so I can change my habits. I also track my investments and see how they are doing.

Custom reports and AI-powered tips give me advice based on my own data. I feel safer because my information is protected. I can manage my money from anywhere, so it is easy to stay on track. Educational resources and community support help me learn more and make smarter choices. Over time, I see that using these tools leads to better results and more confidence in my decisions.

Choosing Software

Assess Needs

When I pick a money management app, I start by thinking about what I want to achieve. I make a list of my goals, like saving for a trip, paying off debt, or tracking investments. I check if the app has the tools I need, such as budgeting, emergency fund planning, or business payment options. I look at how the app keeps my information safe, like using strong passwords and two-factor authentication. I also compare prices. Some apps are free, while others charge a fee. I read reviews from people with goals like mine. I make sure the app follows rules and has good customer support. I check if it can connect to my bank and other accounts.

- Set my financial goals.

- Match app features to my needs.

- Check security options.

- Compare costs.

- Read user reviews.

- Confirm the app follows rules.

- Test customer support.

- Make sure it connects to my accounts.

Tip: I always try a free version first to see if it fits my needs.

Compare Features

I compare features before I decide. Some apps help with investments, while others focus on credit monitoring. I use a table to see the differences:

| Software | Investment Tracking | Credit Monitoring |

|---|---|---|

| Simplifi | Basic investment tracking; no debt payoff tools | Not strong for credit monitoring |

| Truebill | No deep investment analysis | Real-time credit and asset monitoring |

| Quicken | In-depth portfolio tracking | Includes credit score monitoring |

| Refreshme | Basic investment tracking | Basic credit alerts |

Free apps like Mint or HomeBank give me basic budgeting and tracking. Paid apps like Quicken or YNAB offer more tools, such as detailed reports and better support. I choose based on what I need most.

Security

Security matters to me. I want my data safe. I look for these features:

- Multi-factor authentication to keep my account safe.

- Strong passwords and regular updates.

- Firewalls and antivirus protection.

- Encryption for my data at rest and in transit.

- Role-based access so only I can see my information.

- Regular security checks and updates.

- Clear privacy policies that do not sell my data.

- Good customer support for security questions.

I also check if the app follows rules like PCI DSS or GDPR. I want control over my data and clear ways to manage privacy settings.

Note: I always read the privacy policy before I sign up.

I see that using these tools makes managing my money easier and less stressful. I can track spending, set goals, and get alerts that help me stay on top of my bills. Here are some ways these tools help me:

- I save time with automation and real-time updates.

- I get clear reports and advice to make better choices.

- I can see all my accounts in one place.

| What to Look For | Why It Matters |

|---|---|

| Security | Keeps my data safe |

| Customization | Fits my personal goals |

| Automation | Reduces manual work |

| Good Support | Helps when I have questions |

I always try different options to find what works best for my needs.

Frequently Asked Questions for What is personal finance software

How much does personal finance software cost?

Some apps are free. Others charge a monthly or yearly fee. I pay more for extra features like investment tracking or credit monitoring. Here is a quick table:

| Type | Cost Range |

|---|---|

| Free | $0 |

| Paid | $3–$15 per month |

Can I use personal finance software without linking my bank account?

Yes, I can enter transactions by hand. Some apps let me import files from my bank. I choose this if I want more privacy or if my bank does not connect.

Is my financial data safe with these apps?

Most apps use strong encryption and security tools. I always check for two-factor authentication and read the privacy policy before I sign up.

What devices can I use for personal finance software?

I use my phone, tablet, or computer. Some apps work on all devices. Others only work on one. I pick the one that fits my lifestyle best.

Conclusion

Personal finance software is a smart way to take control of your money. Whether you’re saving, investing, or just tracking expenses, the right tool can make a big difference.

Start by exploring free options, then upgrade if needed. The key is consistency—regular updates and reviews will keep your finances on track.

Ready to simplify your money management? Try a personal finance app today!